Time To File You Taxes

Book A Free Consultation

Fraud Examination & Forensic Accounting

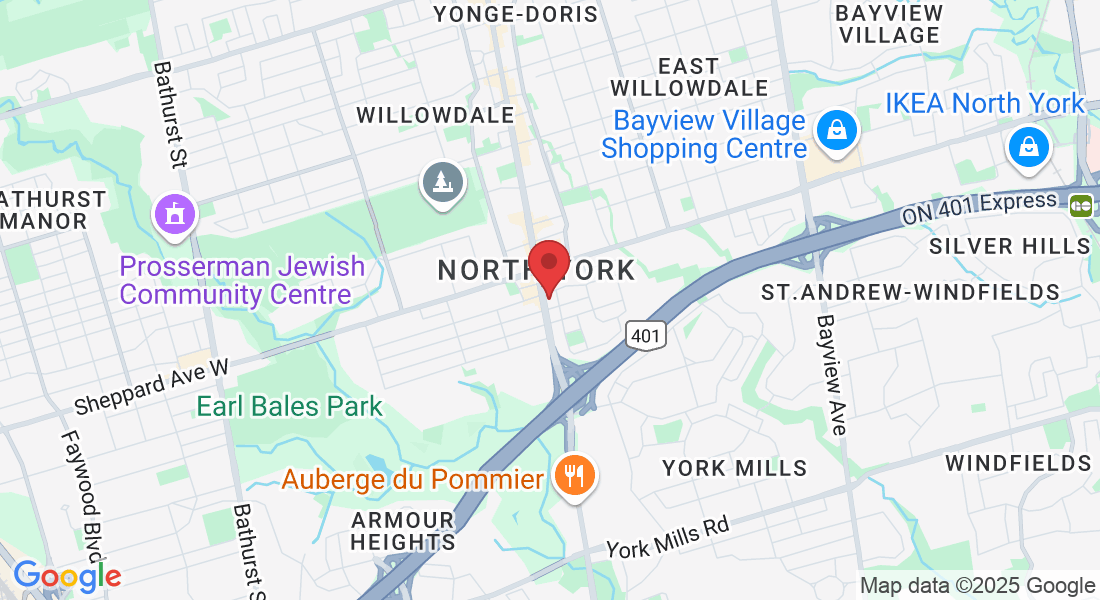

Our team of fraud examiners in Toronto, Canada are here to help. Unfortunately, over a third of Canadians have been victims of fraud. Fraud impacts businesses of all sizes and people of all ages and income brackets. Common types of fraud that businesses face include financial statement fraud, payroll fraud, and asset misappropriation. The types of fraud that individuals frequently face are identity theft, telephone scams and phishing scams.

Our team is certified by:

Why Might You Need A Fraud Examination?

Missing Cash, Inventory, Etc.

If you think your business partner(s), employees or anyone else is stealing cash from your bank accounts, register or, inventory then a fraud examination can provide the evidence to make a case in court.

Overstatement of Assets

If you think your business's balance sheet shows too many assets, then you need to do a fraud examination. Determining how this overstatement happened is essential to properly valuing your organization.

Unrecorded Liabilities

If you think your business's balance sheet shows too few liabilities, then you need to do a fraud examination. Determining what caused these liabilities to be unrecorded is essential to correctly valuing your company.

Insurance

Claims

If you think someone has made a false or inaccurate insurance claim, a fraud investigation by Lynch and Associates will provide you with the evidence you need to build a case against the fraudulent claim.

Payroll

Fraud

If you believe that there are overstated timesheets, fictitious employees or unauthorized pay changes at your company you need a fraud examination to ensure that the payroll fraud is properly identified.

Credit Card

Fraud

If you believe someone has been falsely using your credit card. You may need a fraud examination. We will determine the exact scope of the false use and the next steps for the parties to take in order to resolve the fraud.

Think someone is stealing from your business?

500+

Happy Clients

20+

Years Of Experience

10

Amazing Team Members

Welcome To Lynch & Associates

Meet Jennifer Lynch

Jennifer Lynch is a qualified expert witness in the field of forensic and investigative accounting. Being a Chartered Professional Accountant, a Certified Management Accountant, a Certified Fraud Examiner, a Certified Forensic Investigator, and a Chartered Business Valuator, she offers her clients a variety of services.

Lynch has provided expert witness testimony in a wide variety of trials. Drawing on her strong business background, which includes an MBA from the Schulich School of Business, she provides forensic accounting and fraud examination services related to personal injury damage quantification services, insurance claims, matrimonial disputes, and fraud claims for a wide variety of clients.

Lynch provides prompt, cost-efficient and high-quality services. Please contact her to see how she can be of assistance of you.

Jennifer Lynch, MBA, CPA, CMA, CFE, CFI,CBV, ABV

President of Lynch & Associates

TESTIMONIALS

What Our Clients Say

"Her reports are accurate and thorough"

Our firm has engaged the services of Lynch & Associates for the past 12 years. Ms. Lynch has done an excellent work in preparing economic reports addressing claims for past and future loss of income, future medical and rehabilitation benefits and attendant care expenses. We are extremely pleased with her services. Her reports are accurate and thorough. I would highly recommend her services.

- Gurcharan Anand, G. S. Anand Legal Professional Corporation

"Thank you for all of your hard work."

Thank you for all of your hard work. We have successfully used your reports to resolve some very contentious loss of income claims. Your thorough and detailed reports proved to be very effective in calculating our client’s losses accurately and defensibly. Please keep up the good work!

- Gus Triantafillopoulos, Trianta Longo LLP – Personal Injury Lawyers

"They provide accurate & well-reasoned reports"

I have used Lynch and Associates for over 6 years and they have provided excellent service and quality reports that assist me and my clients in accurately quantifying their damages. Lynch and Associates provide strong and sensible reports with respect to economic loss, future cost of care, Income replacement benefit calculations and more. They provide accurate and well-reasoned reports in very timely fashion and have assisted my efforts in gaining compensation for my clients many times. I thank Lynch and Associates for their hard work and I look forward to working with Jennifer and her reliable team for the foreseeable future!

- Patrick A. D’Aloisio , Barrister and Solicitor, Romano Law Firm

Frequently Asked Questions

How does forensic accounting differ from traditional accounting?

Traditional accounting focuses on recording and reporting financial information, while forensic accounting emphasizes investigating and analyzing financial data to detect fraud and support legal cases.

What are the typical steps in a forensic accounting investigation?

The process generally includes planning, data collection, data analysis, reporting findings, and, if necessary, providing expert testimony.

How long does a forensic accounting investigation take?

The duration varies based on the complexity and scope of the case, ranging from a few weeks to several months.

What qualifications should a forensic accountant have?

A qualified forensic accountant typically holds certifications such as Certified Fraud Examiner (CFE) or Chartered Professional Accountant (CPA) and has specialized training in fraud detection and investigation. Our team at Lynch and Associates are MBAs, CPAs, CMAs, CFEs, CFIs, CBVs, ABVs, and CVs.

Can forensic accountants assist in legal proceedings?

Yes, they can provide expert testimony, prepare detailed reports, and offer insights that support legal arguments in court.

Are forensic accounting services confidential?

Yes, forensic accountants adhere to strict confidentiality agreements to protect sensitive information.

What is the cost of a forensic accounting investigation?

Costs vary based on the investigation's complexity, scope, and duration. It's advisable to discuss fees upfront with the service provider.

Clients Feedback

Our Clients Reviews

Just a few of hundreds of happy clients!

Dwight Taylor

Mason and the entire team offer outstanding service, knowledge, and care. When working with Mason I feel like I am his most important client, and this is one of the many reasons I recommend him to family and friends, Dwight Taylor

Ron Dunne

I’ve been extremely pleased with Mason and his team since we connected 2 years ago. I used to do my own taxes when working full time, and when I became self-employed. Once I incorporated, I knew I’d need help, and that’s where Mason and his team came in.

There expertise has saved me thousands of dollars that I was not aware were available. Prompt courteous service…and very easy.

Simply load docs online and the next thing you know, Mason has your returns done.

In addition to my corporate taxes, Mason completed my personal, as well as my daughter’s.

Without hesitation, I would recommend Collective Accounting to help complete your taxes.

Dan Hall

Mason and Debbie have always done an amazing job filing our personal taxes for us. Everything is taken care of efficiently on-line. This year Mason found and filed for an exemption for my wife who was looking at paying a huge capital gains tax on the sale of an investment property. Without Mason we would not have known anything about this. He knows his stuff and knows the right questions to ask. Always available to answer our questions via email or phone. Very knowledgeable and thorough. Highly recommend!

Still Not Sure If Lynch & Associates Is Right?

Book a NO OBLIGATION consultation with our team of fraud investigators.